Context: What Are Tariffs?

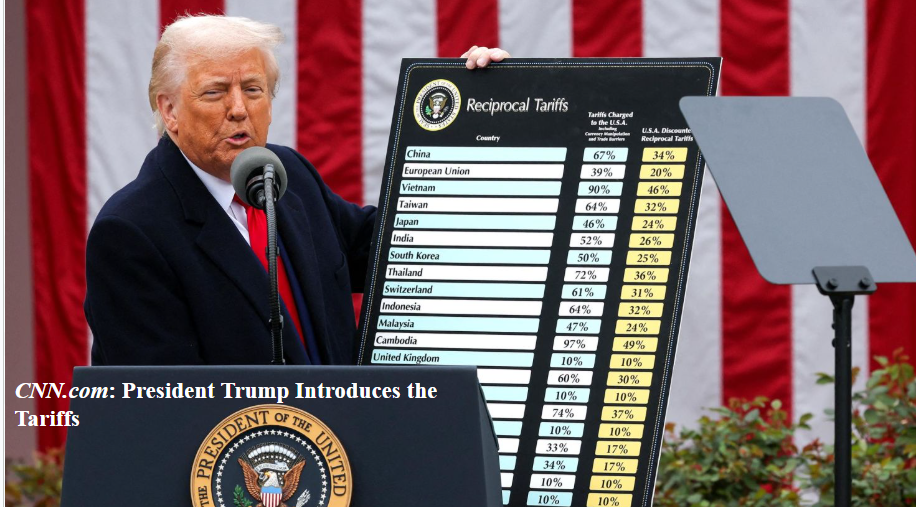

A tariff is defined as a tax imposed on a good or service imported from another country. The tax is usually paid for by the importer to the government of the importing country. Due to the ongoing trade war, U.S. President Donald Trump had introduced tariffs of up to 145% on Chinese goods. However, China responded with a 125% tax on imported American goods. Companies that bring foreign goods into the country have to pay the tax to the U.S. government.

The Reason Behind The Decision

Trump is establishing these tariffs to encourage U.S. consumers to purchase more American-made products, increasing the amount of taxes raised and leading to huge levels of investment in the country. He wants to reduce the gap between the value of goods that the United States buys from other countries and those it sells to them. His main targets were China, Mexico, and Canada, due to the majority of goods and services coming from these countries.

The Economic Impact

A direct increased tax on imported goods can fall on either domestic or international consumers and businesses. This depends on certain factors, such as supply and demand for each product and the businesses’ ability to pass on costs to customers. Overtime, the burden will likely fall on the consumer rather than the business, though, this is only predicted. A reduction in imported goods may also occur, which would involve foreign governments purchasing fewer American assets, including U.S. federal government bonds.